how are 457 withdrawals taxed

The only difference is there are no withdraw penalties and that they are the only. For this calculation we assume that all contributions to the retirement account.

When you take out money in retirement you pay income taxes on the withdrawals.

. The amount you wish to withdraw from your qualified retirement plan. June 5 2019 1155 AM. Unlike other tax-deferred retirement plans such as IRAs or.

The IRS will impose a 10 percent penalty on early withdrawals from a traditional IRA or 401k for example but not a 457 plan from which you can take penalty-free distributions beginning at. Ad See How a 457b Could Help You Meet Your Goals And Save For Tomorrow. Withdrawals are subject to income tax.

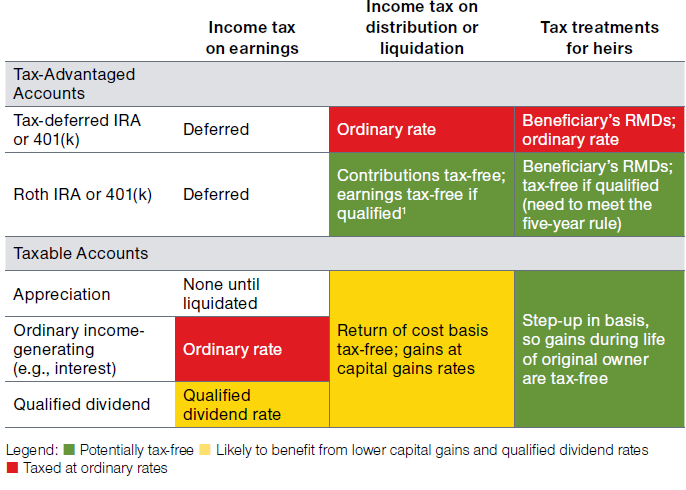

Any attempted rollovers to an IRA of amounts distributed from a 457f plan or a 457b plan maintained by a tax-exempt entity are excess contributions that are subject to IRC. In my experience if a non-profit employer discusses the implications of 457 f in advance with a competent professional it will know how 457 f. All distributions from IRAs 401 ks 403 bs and 457 accounts are subject to income taxes at ordinary income tax rates.

We pay into a 457 retirement account. Isnt this tax deductible. You are permitted to withdraw money from your 457 plan without any penalties from the Internal Revenue Service no matter how old you are.

How the 457 b plan works. Withdrawals from 457 retirement plans are taxed as ordinary income. Contributions to your 457 b plan are reported on your.

Withdrawals are subject to income tax. You will still however need to. Funds are withdrawn from an employees income without being taxed and are only taxed upon withdrawal which is typically at.

When you retire or leave your job for any reason youre permitted to make withdrawals from your 457 plan. A 457 b is similar to a 401 k in how it allows workers to put away money into a special retirement account that provides tax advantages. 457 plans are taxed as income similar to a 401 k or 403 b when distributions are taken.

Under the Internal Revenue Code you can take money from a 457 early without paying the 10-percent early withdrawal penalty but youll still have to pay taxes on the money. June 5 2019 1155 AM. The amount you wish to withdraw from your qualified retirement plan.

Ad See How a 457b Could Help You Meet Your Goals And Save For Tomorrow. You are permitted to withdraw money from your 457 plan. However distributions from a ROTH 457 plan are not subject to tax withholding.

With a Roth 457b you fund your account with money thats already been taxed in exchange. I only state if not all since I am not completely versed in all the varieties of 457 plans but if you. Most 457 plans if not all are considered taxable once you draw the money out.

For this calculation we assume that all contributions to the retirement account. Posted November 11 2014. The recipient may be able to choose to 1 pay tax on a portion of the distribution at a 20 tax rate or 2 compute the tax on some or all of the distribution by averaging the.

So if you need to tap into your 457b contributions before you reach age 595 and youve left the job that provided you with the 457b dont fret. Employees are taxed on distributions from a 457 retirement plan if the distributions are includible in the participants income. A distribution is not included in income and therefore.

However you will have to pay income taxes on the. A 457 plan is a tax-deferred retirement savings plan. Plans of deferred compensation described in IRC section 457 are available for certain state and local governments and non-governmental entities tax exempt under IRC Section 501.

6 Smart Strategies For Reducing Retirement Taxes

401 K Inheritance Tax Rules Estate Planning

Taxes In Retirement Three Tax Planning Tips

How To Make Your Retirement Account Withdrawals Work Best For You T Rowe Price

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

What Are Defined Contribution Retirement Plans Tax Policy Center

5 Tax Savvy Retirement Withdrawal Strategies Apprise Wealth Management

Ownership Of Iras And 401k Plans By Canadians

Strategies For Managing Your Tax Bill On Deferred Compensation Turbotax Tax Tips Videos

Managing Your Overseas Ira And The Us Income Tax Implications

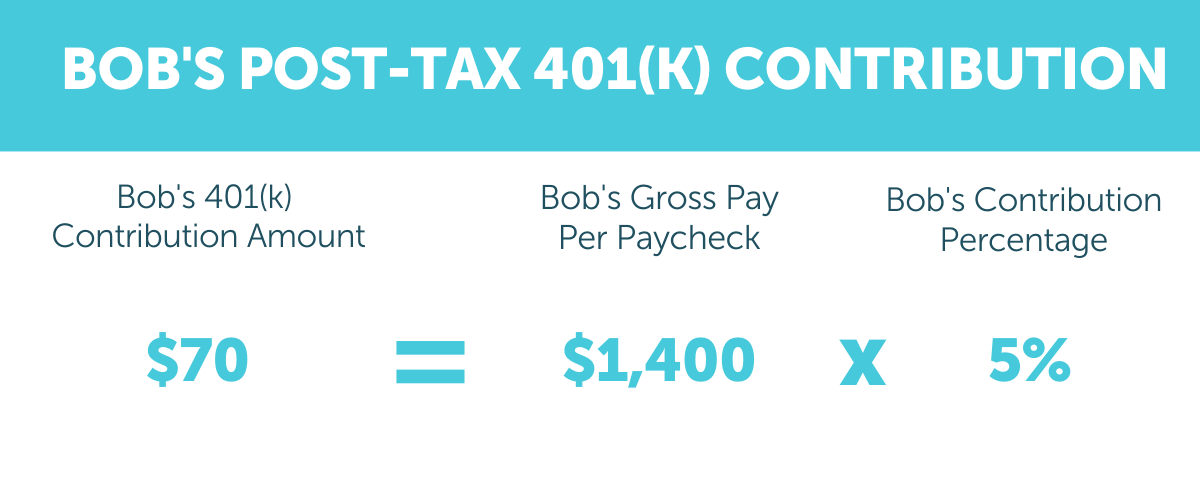

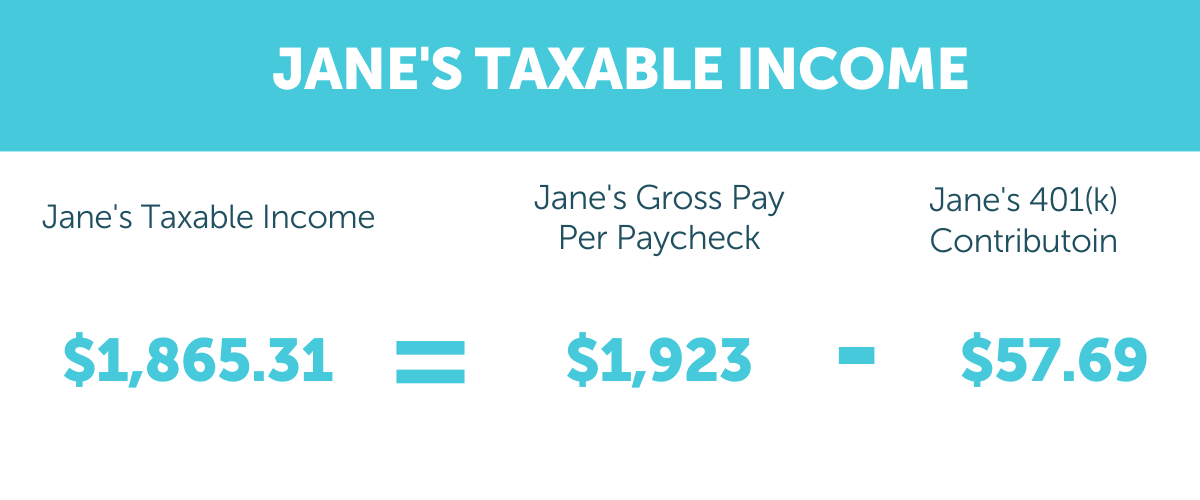

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Retirement Income Calculator Faq

How To Manage Retirement Withdrawals To Pay Less In Taxes And Maximize Income Newretirement

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Covid 19 Early Retirement Plan Withdrawal Taxes

How Are Defined Benefit Plans Taxed Impact On Income And Payroll Taxes Saber Pension

What Is Fica Tax Understanding Payroll Tax Requirements Freshbooks Resource Hub