kentucky sales tax on-farm vehicles

In addition to taxes car purchases in Kentucky may be subject to other fees like registration title and plate fees. Exempt from additional fuel usage tax in Kentucky IFTA and KIT.

Member Benefits Kentucky Farm Bureau

There are no local sales and use taxes in Kentucky.

. You can find these fees further down on the page. Diesel fuel or write the taxes payed for road fule used in your tractor. 2019 Kentucky legislation made further changes to provide an exemption for resale for newly taxable services established sales and use tax collection.

The use tax is imposed on the storage use or other consumption of tangible property. While the statutory provisions for agriculture sales and use tax exemptions have not changed. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

Exempt from medical certificate intrastate. Gross Kentucky sales and use tax line 1 x 06 Claimed compensation line 2 Deduct 175 of the first 1000 and 15 of the amount in excess of 1000 with a 50 cap. Kentucky currently exempts farm plated vehicles buses and government vehicles.

Items that can be purchased sales tax free for legitimate farm use. It is intended to be used as a quick. August 24 2021 The Kentucky Department of Revenue DOR is now accepting applications from eligible farmers for new agriculture exemption numbers designed to protect the sales and use tax exclusions available to the agricultural community.

Total compensation may not exceed 50 Net Kentucky sales and use. SALES AND USE TAX The sales and use tax was first levied in its current form in 1960. Exempt from axle weights gross highway weight rates still apply if licensed as a farm vehicle and not.

Exemptions are different for each state. In the farm vehicles that will be traveling on federal state and county highways. Sales and Use Tax Laws are located in Kentucky Revised Statutes Chapter 139 and Kentucky Administrative Regulations - Title 103.

This page discusses various sales tax exemptions in Kentucky. Or vehicles with 3 or more axles regardless of weight to report fuel use tax. Kentucky Sales and Use Tax is imposed at the rate of 6 percent of gross receipts or purchase price.

Exempt from additional fuel usage tax in Kentucky IFTA and KIT. For FY 2015 this tax generated 3267 billion. While the Kentucky sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation.

Hardware like nuts bolts screws nails. This license is required for interstate carriers with a gross vehicle weight or a registered gross vehicle weight exceeding 26000 lbs. Certain goods are exempt from sales and use tax including coal and other energy-producing fuels certain medical items locomotives or rolling stock certain farm machinery and livestock certain.

Feed and feed suplanents. Sales and Use Tax. Exempt from weight distance tax in Kentucky KYU.

Exempt from periodic annual inspection intrastate. Exempt from weight distance tax in Kentucky KYU. Fence and fencing supplys.

In Kentucky certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. The tax is collected on retail sales within the state at a rate of 6 percent of the sales price. Aug 16 2012.

2018 Kentucky legislation expanded the types of services subject to sales tax established economic nexus thresholds for remote retailers and amended certain excise taxes. Sales Tax Exemptions in Kentucky.

License Plates Personalized Plates Drive Ky Gov

Homestead Exemption Department Of Revenue

Car Insurance For High Risk Drivers In Kentucky Bankrate

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Governor Ruby Laffoon Cabin Visit Madisonville Kentucky My Old Kentucky Home Cabin Farm Life

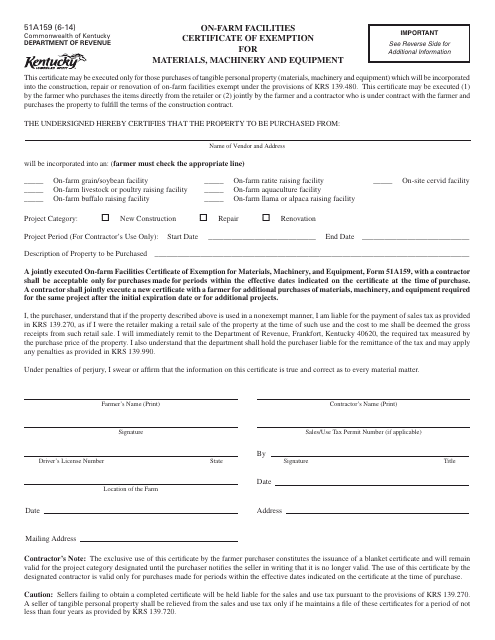

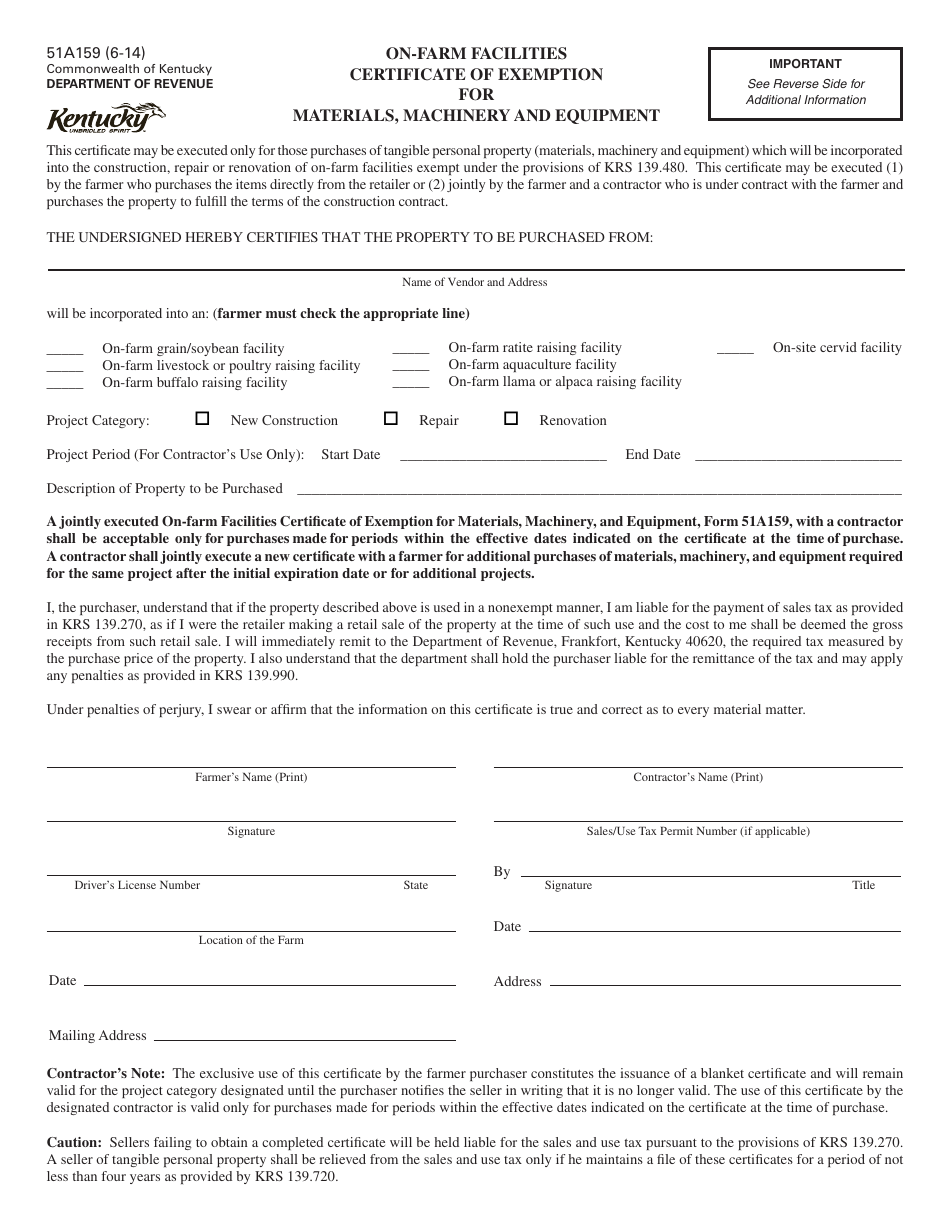

Form 51a159 Download Printable Pdf Or Fill Online On Farm Facilities Certificate Of Exemption For Materials Machinery And Equipment Kentucky Templateroller

Form 51a159 Download Printable Pdf Or Fill Online On Farm Facilities Certificate Of Exemption For Materials Machinery And Equipment Kentucky Templateroller

Kentucky Governor Halts Vehicle Tax Increase Calls For 1 Sales Tax Drop To Fight Inflation News Wevv Com

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

State Farm Liability Auto Insurance In 2021 State Farm Insurance Insurance Policy Car Insurance

What Transactions Are Subject To The Sales Tax In Kentucky

Answers To Common Agriculture Tax Exempt Questions Lifestyles Somerset Kentucky Com

Filing A Kentucky State Tax Return Credit Karma Tax

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

License Plates Personalized Plates Drive Ky Gov

Kentucky House Votes To Give Relief On Vehicle Tax Bills News Wdrb Com